will salt deduction be eliminated

This significantly increases the boundary that put a cap on the SALT. SALT deductions were limited to 10000 as part of former President Donald Trumps tax reform plan in 2017 hurting residents of high-tax states like New York and New.

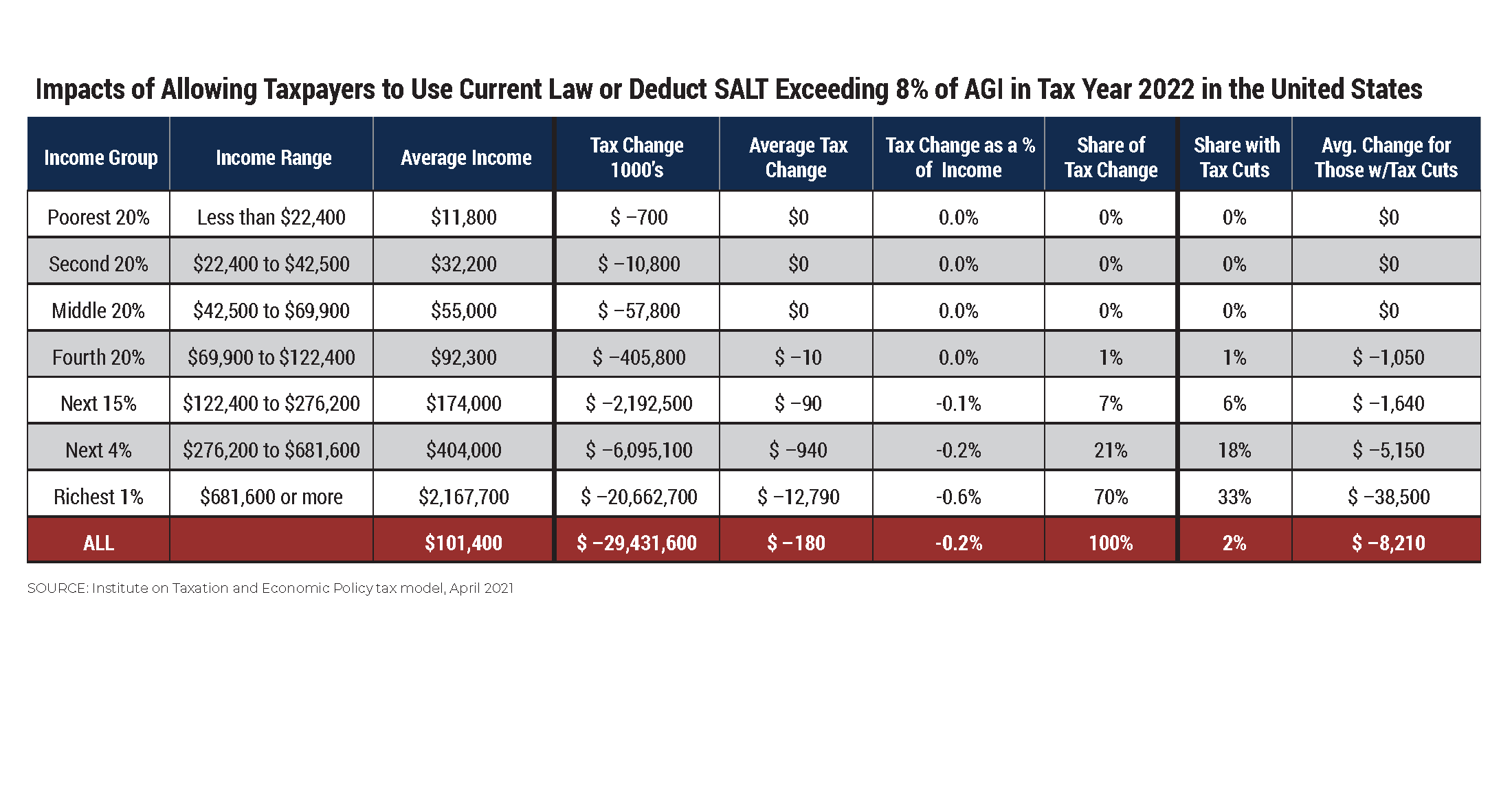

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

As a result of this legislation the SALT deduction has been reduced.

. However I am not as certain as the editorial board that the deduction for state and local taxes SALT should be eliminated now. Will Salt Deduction Be Eliminated. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

The first idea involves the 10000 limit on state and local income and real estate taxes that can be deducted on federal tax returns. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break. Simultaneously the Act increased the standard deduction from 6500 to.

Trumps tax law limited SALT deductions to 10000 meaning that residents in higher-tax states like New York and New Jersey could no longer deduct the full value of their. The Tax Cuts and Jobs Act. New limits for SALT tax write off.

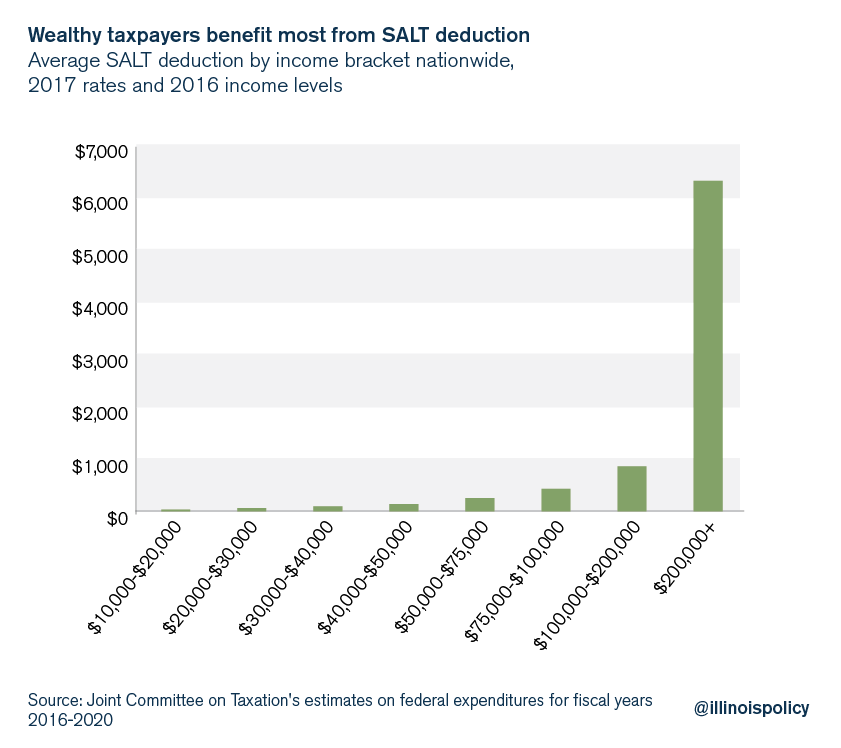

After legislators realized the impact of. Richard Reeves explains why the deduction for state and local taxes--the SALT deduction--is regressive benefits the wealthiest taxpayers and should be eliminated. The SALT deduction does favor the wealthy.

The Tax Cuts and Jobs Act of 2017 placed a cap on state and local tax deductions SALT of 10000. House Democrats passed a coronavirus relief bill in May that would repeal the SALT deduction cap for two years but that bill is not expected to be considered in the. By Brad Dress - 080722 636 PM ET Greg Nash House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will.

This so-called SALT cap was inserted into. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. The first idea involves the 10000 limit on state and local income and real estate taxes that can be deducted on federal tax returns.

However at higher income and tax rate levels the top 5 and 1 of income earners would see an increase in after-tax income of 125 and 279 respectively should the. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. During initial talks about tax reform the SALT deduction was almost eliminated.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

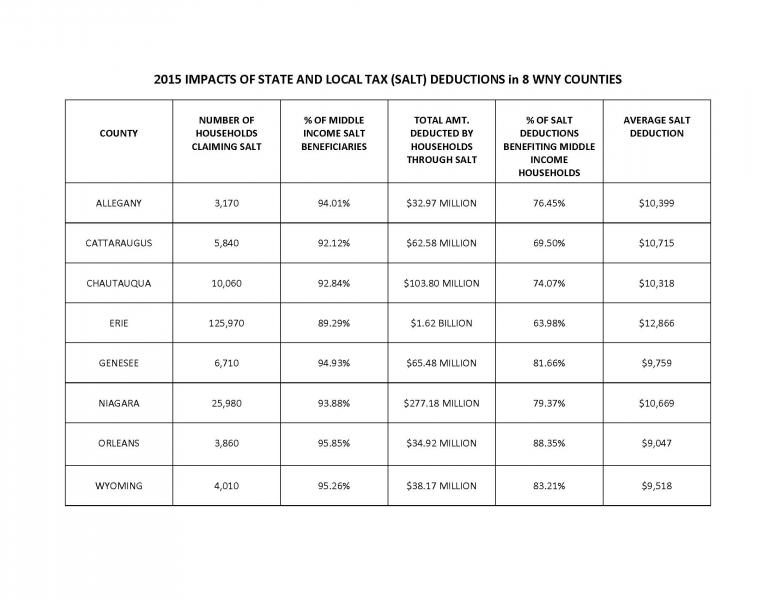

Poloncarz Higgins Sound Alarm On Federal Budget Plan To Eliminate State Local Tax Deductions Erie County Executive Mark C Poloncarz

House Votes To Eliminate Salt Deduction Cap Offering Relief To New Jersey And Other High Tax States

Infographic On Tax Deduction Changes For 2018 Dedicated Db

Changes To Federal Salt Deduction Expose Illinois High Taxes

Rich Democratic Lawmakers Stand To Benefit From The Salt Tax Cuts

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Salt Cap Repeal Salt Deduction And Who Benefits From It

Porter Backed Bill Seeks To Restore Salt Deductions Capped Under 2017 Tax Act Orange County Register

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Salt Deduction Cap Should Be Reformed Not Repealed Itep

Is Salt Kosher Democrats Favorite Tax Cut For The Rich Arcadia Political Review

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

N J House Democrats Slammed For Support Of Spending Bill Without Salt Deal New Jersey Monitor

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center